The development of sustainability can’t be reversed, and ESG standards are more and more necessary

In keeping with Avision Younger Vietnam, most new workplace buildings within the metropolis. HCM and Hanoi each pursue inexperienced certification and broaden to areas surrounding town.

On the identical time, industrial actual property is selling the greening development with excellent initiatives resembling: Hitachi Vitality Manufacturing facility (Bac Ninh), Logicross Hai Phong (Mitsubishi Property) and Lego Vietnam manufacturing facility (Binh Duong). ..

This development displays excessive market demand, selling funding in inexperienced buildings. Tasks that meet environmental, local weather and ESG (Environmental Social Governance – Governance – Society and Setting) requirements typically have excessive appraisal worth, are simple to draw capital and are an necessary think about transactions. mergers and acquisitions (M&A).

Greening industrial actual property “takes the throne”. Picture: TN

AnyIndustrial actual property faces new alternatives

The commercial actual property section continues to be a brilliant spot within the Vietnamese market with elevated rents, provide and excessive occupancy charges. The principle driving drive for this growth comes from overseas funding flows into manufacturing industries and China+1.

In key and tier 1 markets, industrial land rental costs elevated by a mean of two – 5%/quarter. In the meantime, new provide guarantees to be considerable when many industrial park initiatives are licensed or began throughout the nation. Industrial and logistics actual property remains to be the section of prime curiosity to overseas traders.

Industrial actual property faces new alternatives. Picture: BXD

Avision Younger Vietnam commented: Within the quick time period, financial, commerce and political fluctuations because of the affect of the insurance policies of latest US President Donald Trump could put rapid strain on attracting funding. overseas funding and export.

In the long run, Vietnam, with some great benefits of geographical location, relative political stability, aggressive prices and an more and more enhancing funding setting, can turn into the subsequent manufacturing base on this planet. globally if we seize the chance promptly.

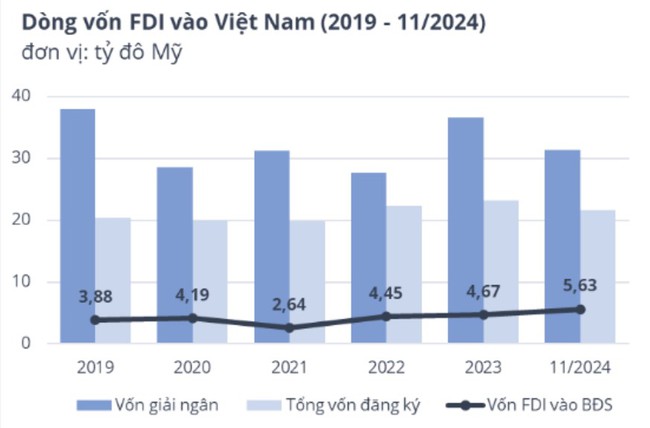

FDI into Vietnamese actual property elevated sharply regardless of a slowing world context

Within the context that international manufacturing has not totally recovered and main markets world wide are fairly gloomy, FDI capital flows in Vietnam are inclined to stream extra into the true property sector. In 11 months, registered FDI capital in the true property trade elevated by 89.1% over the identical interval, reaching about 5.63 billion USD.

With this rising momentum, mixed with efforts to disburse FDI capital on the finish of the 12 months, it’s seemingly that by the tip of 2024, the whole realized FDI capital in Vietnam might be larger than final 12 months and attain a brand new report within the interval 2019 – 2024. .

Screenshot

Sturdy FDI inflows present the attractiveness of Vietnam’s actual property market within the eyes of overseas traders. Not solely do traders positively consider coverage situations, funding setting, inhabitants or urbanization, however in addition they see demand exceeding provide in key segments resembling trade.

Due to this fact, efforts to enhance the true property authorized framework and infrastructure growth are contributing to creating the market extra enticing to worldwide traders.

The housing section is on the trail to restoration amid a chronic provide hole. Picture: TN

The good modifications in 2024 in insurance policies, funding traits or enterprise context are the idea for us to proceed to take care of an optimistic imaginative and prescient of the Vietnamese actual property market. Due to this fact, when optimistic indicators seem extra clearly, it’s time to restart capital stream into transactions and be able to welcome a brand new development cycle.

Mr. David Jackson, Normal Director of Avison Younger Vietnam commented

In keeping with a report by Avision Younger Vietnam, in 2024, the housing market will present extra optimistic indicators. Within the metropolis. In HCM, new initiatives are primarily within the high-end section, priced at 72 – 142 million VND/m2. In Hanoi, promoting costs elevated sharply at the start of the 12 months and haven’t cooled down till the tip of the 12 months, residences over 70 million VND/m2 appeared extra from the third quarter, major costs within the fourth quarter elevated by 2 – 4% in comparison with the earlier quarter.

Moreover, the event of reasonably priced housing faces many challenges. Insurance policies and preferential credit score sources for social housing usually are not enticing sufficient and procedures for investing in, renting, and shopping for social housing are nonetheless difficult.

As well as, Avision Younger Vietnam additionally believes that 2024 is the 12 months that marks a authorized milestone when the three Legal guidelines associated to actual property take impact. Modifications and changes within the regulation are extremely appreciated for his or her transparency, readability and equity, serving to to professionalize brokerage actions, laying the inspiration for the market to develop healthily and sustainably.

![Trump goes to talks about Russia’s ceasefire: Russia is being put under pressure for ceasefire [トランプ再来]: Asahi Shimbun Trump goes to talks about Russia’s ceasefire: Russia is being put under pressure for ceasefire [トランプ再来]: Asahi Shimbun](https://i1.wp.com/imgopt.asahi.com/ogp/AS20250313000723_comm.jpg?w=350&resize=350,250&ssl=1)

![Trump goes to talks about Russia’s ceasefire: Russia is being put under pressure for ceasefire [トランプ再来]: Asahi Shimbun Trump goes to talks about Russia’s ceasefire: Russia is being put under pressure for ceasefire [トランプ再来]: Asahi Shimbun](https://i1.wp.com/imgopt.asahi.com/ogp/AS20250313000723_comm.jpg?w=120&resize=120,86&ssl=1)